UMP staff need to manage their finances wisely

PEKAN, 12 July 2021 - The implementation of moratorium 2.0 announced by the government on 7 July is a wise step taken to reduce the burden of the people as well as to continue to survive.

A survey conducted by Bank Negara Malaysia (BNM) found that 75 per cent of Malaysians do not have at least RM1,000 in savings.

Thus, the 2.0 moratorium is seen as an opportunity in addition to offering a solution to improve the finances of the affected individuals.

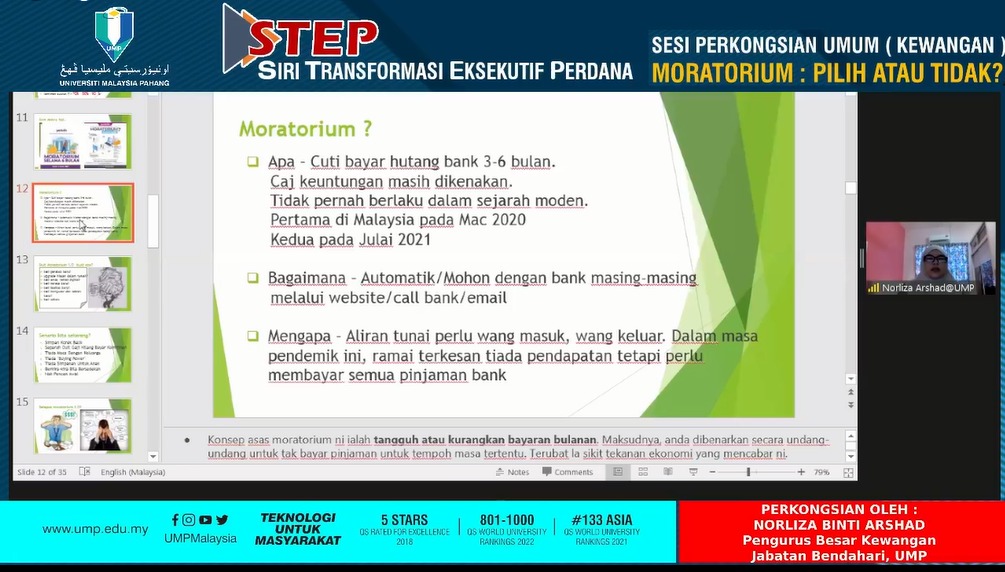

According to the Finance General Manager, Bursary Office, Universiti Malaysia Pahang (UMP), Norliza Arshad, the moratorium is simply a holiday from debt repayment or deferment granted by the bank for three to six months due to lack of cash inflow or outflow.

“Borrowers should understand that by applying for a moratorium, the cost of borrowing will increase overall as interest and profits will continue to be taken into account on outstanding loan repayments.

“Every financing has the effect of mortgage reducing term takaful (MRTT), which is the value of protection, but there is a risk of no additional protection when taking the moratorium.

“UMP staff are also advised to have a healthy financial position. This means having a low commitment and being able to be resilient to the current situation and able to anticipate future challenges in the next five or ten years,” she said.

Apart from that, she said, we are also advised to stay away from debts such as ar-rahnu or credit cards.

“This debt is a liability that needs to be paid for something that has no return value and even has depreciation value.

“So, the decision to take a moratorium or not differs for everyone because it depends on different situations,” she said in the Siri Transformasi Eksekutif Perdana (STEP) Webinar programme titled ‘Sesi Perkongsian Umum: Moratorium: Pilih atau Tidak’.

She said, if you do not have an emergency fund for six months or want to settle debts in a short period, then it is recommended to take a moratorium but be wise to plan to manage this fund.

She added that any staff who apply for a moratorium must inform the approval of the moratorium to the Salary Unit, Bursary Office, UMP.

UMP also offers financial courses to staff such as personal financial management, debt management and how to settle debts wisely, tax management/PCB/CP38, zakat management, choose moratorium or not, faraid (property division) management, retirement planning, and investment risk and return.

The programme conducted through Zoom was moderated by the Registrar’s Office to share with UMP staff on healthy financial management.

By: Siti Nurfarmy Ibrahim, Corporate Communications Unit, The Office Of The Vice-Chancellor (PNC)

Translation by: Dr. Rozaimi Abu Samah, Engineering College/Faculty of Chemical and Process Engineering Technology

- 52 views

Reports by:

Reports by: